PortIQ — Portfolio & Risk Dashboard

One place for exposures, stress paths, liquidity, and board-ready reporting—powered by global market data and DFA analytics engines.

The Problem

- Fragmented dashboards across asset classes and geographies

- Manual stress testing with stale assumptions

- Weeks to produce board reports; months to onboard new scenarios

- Black-box models that fail to explain risk drivers

The Solution

- Unified exposure view across all asset classes in real-time

- Interactive stress studio with historical and custom scenarios

- One-click board reports with automated scheduling

- Full explainability with audit trails and attribution

Core Capabilities

Everything you need to monitor, stress-test, and report on institutional portfolios.

Unified View

Consolidate all exposures—equities, fixed income, alternatives, derivatives—into a single, intuitive dashboard with real-time aggregation.

Factor & Regime Analysis

Decompose risk by style factors, macro regimes, and hidden correlations. Identify vulnerabilities before they materialize.

Stress Studio

Build custom stress scenarios or replay historical crises. See P&L impact in seconds with full attribution breakdown.

Liquidity & Implementation

Model liquidation horizons, transaction costs, and market impact across varying redemption scenarios.

Board Reports

Generate presentation-ready reports with one click. Customizable templates for committees, boards, and regulators.

Governance & Audit

Full audit trails, version control, and role-based access. Meet compliance requirements with confidence.

What Makes PortIQ Unique

Narratives → Math

Describe a scenario in plain language—"Tech selloff with credit widening"—and PortIQ translates it into quantitative shocks across your portfolio. No more spreadsheet gymnastics.

"Central bank surprise + EM contagion"

Explainability First

Every number comes with context. Drill into any metric to see the underlying drivers, historical precedents, and methodological assumptions. Built for trust, not black boxes.

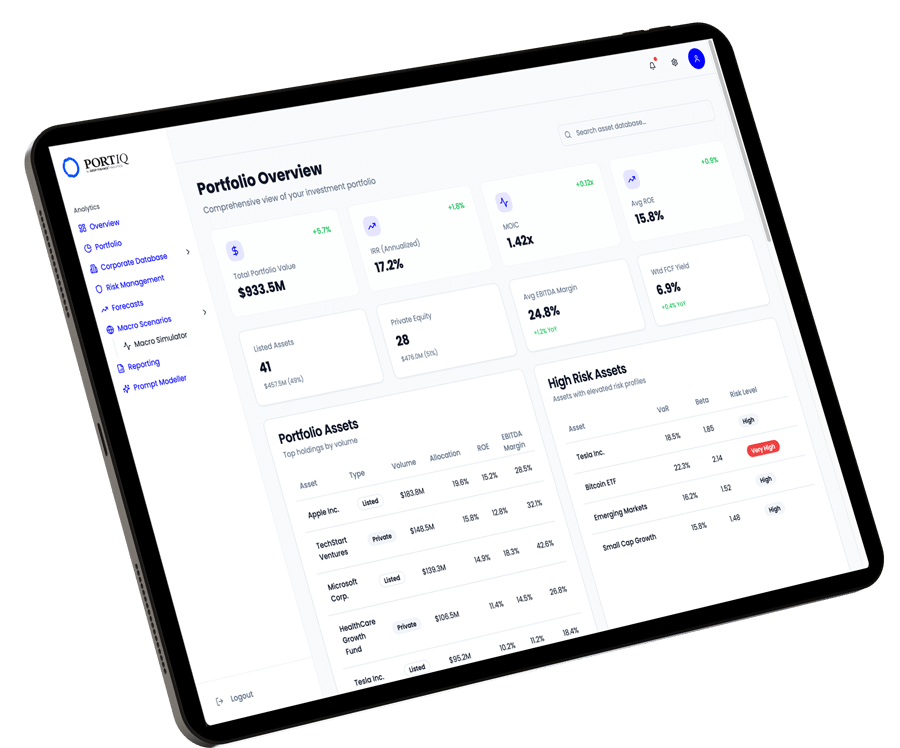

See PortIQ in Action

A unified view of your entire portfolio—exposures, risks, and opportunities.

Built for Institutional Investors

PortIQ serves the world's most demanding asset owners and managers.

Sovereign Wealth Funds

Manage multi-trillion portfolios with transparency, long-horizon scenario planning, and stakeholder-ready reporting.

Pensions & Endowments

Balance liability-driven mandates with growth objectives. Model funding ratios under stress and communicate clearly to trustees.

Multi-Asset PMs

Navigate cross-asset allocation decisions with integrated factor views, regime signals, and implementation analytics.

Enterprise-Grade Security

Your data is protected by the same standards trusted by central banks and sovereign funds.

Frequently Asked Questions

Ready to Transform Your Portfolio Analytics?

Join leading institutional investors who trust PortIQ for their mission-critical decisions.